what is the property tax rate in dallas texas

There are a number of exemptions that help lower. The median property tax on a 12970000 house is 282746 in Dallas County.

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Texas Mortgage Interest Rates.

. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates. The propositions will appear on the top of voters ballots above any. Improved Market Areas Land Market Areas.

As of the 2010 census. In Texas a property owner over the age of 65 cant freeze all property taxes. FY 2022 property tax rate for general services.

Find Property Tax Rates for Dallas Forth Worth. The Comptrollers office provides resources for taxpayers appraisers and others. Find Your DFW Mortgage Lender.

The median property tax also known as real estate tax in Dallas County is 282700 per year based on a median home value of 12970000 and a median effective property tax rate of 218 of property value. DFW Dallas Fort Worth Property Tax Rates. This is the case this year.

Free Utility Connect Concierge Service. Texas Property Tax Exemptions. 1 2020 tax rates and tax rate related information is reported to the comptroller on Form 50-886-a Tax Rate Submission Spreadsheet XLSX.

Details on the submission process is included in the Electronic Appraisal Roll Submission Manual PDF. 617 of 1000 of taxable value The county general services levy is for all property located in incorporated areas or cities. Whether you are already a resident or just considering moving to Dallas County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700. Dallas County collects very high property taxes and is among the top 25 of counties in the United States ranked. Contact ARG Realty LLC.

214 653-7811 Fax. And Texas voters have the chance in a May 7 constitutional amendment election to expand homestead exemptions that could lower the amount of property values upon which property taxes can be levied. There are no obvious changes in rates from 2020 to 2021.

Compare by city and county. The median property tax on a 12970000 house is 234757 in Texas. Texas Home Warranty Companies.

Records Building 500 Elm Street Suite 3300 Dallas TX 75202. The levies shown do not reflect actual tax collections. Ad Call The Experts Today For A Speedy Answer To Your Property Tax Loan Questions.

Fort Worth and Houston are both slightly higher estimated rates are 2321 percent and 2259 percent respectively and San Antonio and Austin are slightly lower estimated rates are 2097 percent and 1973 percent. This freeze amount is based on the year the individual qualified for the 65 or older exemption and can. Homes are appraised at the beginning of the year and appraisal review board hearings generally begin in May.

However they do have the option of applying for a tax ceiling exemption which will freeze the amount of property taxes paid to the school district. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Texas Property Tax System.

104 rows Dallas County is a county located in the US. Within Texas the Dallas combined property tax rate is on par with other major cities. Paying Your Property Taxes.

The median property tax on a 12970000 house is 136185 in the United States. In Collin County last year 27195 protests made it to the appraisal review board. More than half of that tax goes to local schools.

Electronic Notification System ENS Public Information - Open Records Requests. Early voting for the two propositions began Monday and runs through May 3. Business Personal Property BPP Business Personal Property BPP Deadlines and Penalties.

This website is for informational purposes only. Dallas County collects on average 218 of a propertys assessed fair market value as property tax. Learn all about Dallas County real estate tax.

Learn about Dallas metro property tax rates - Property tax rates for all major DFW metroplex citiestowns school districts and DFW metroplex counties. In Texas local governments collect property tax and set rates. The average homeowner in Dallas County pays 3124 annually in property taxes and pays taxes at an effective rate of 193.

Property tax rates in Dallas County are slightly lower than those in Harris County but still significantly higher than the national average. Typically property tax rates do not change drastically year to year. Almost half of them 13068 resulted in a change in valuation.

Dallas County has one of the highest median property taxes in the United States and is ranked 194th of the 3143 counties in order of median property taxes. The 2021-2022 tax rates are calculated by Dallas County PDF in accordance with Texas Tax Code.

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Texas Sales Tax Small Business Guide Truic

Property Tax Comparison By State For Cross State Businesses

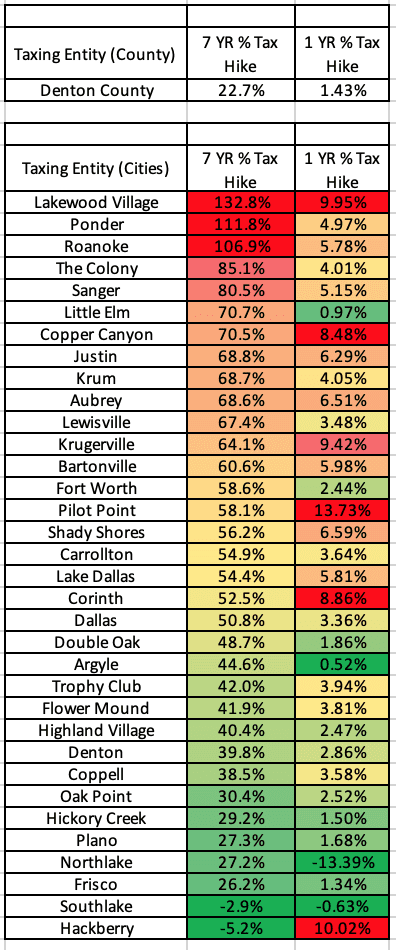

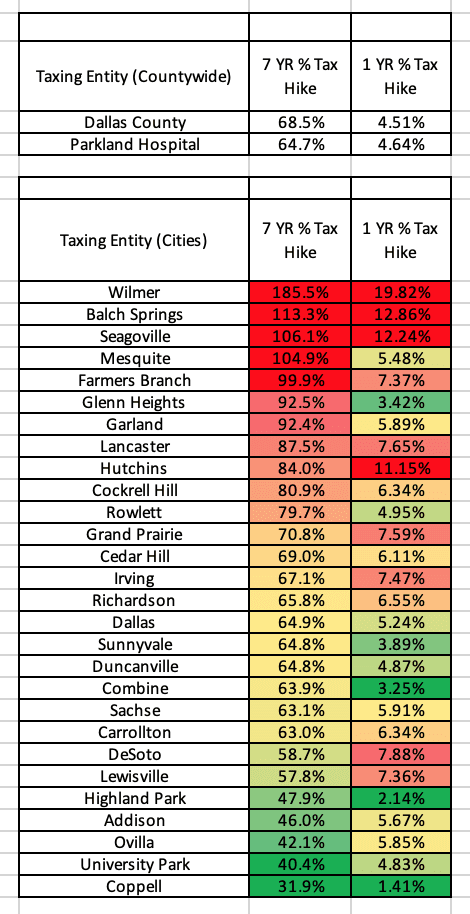

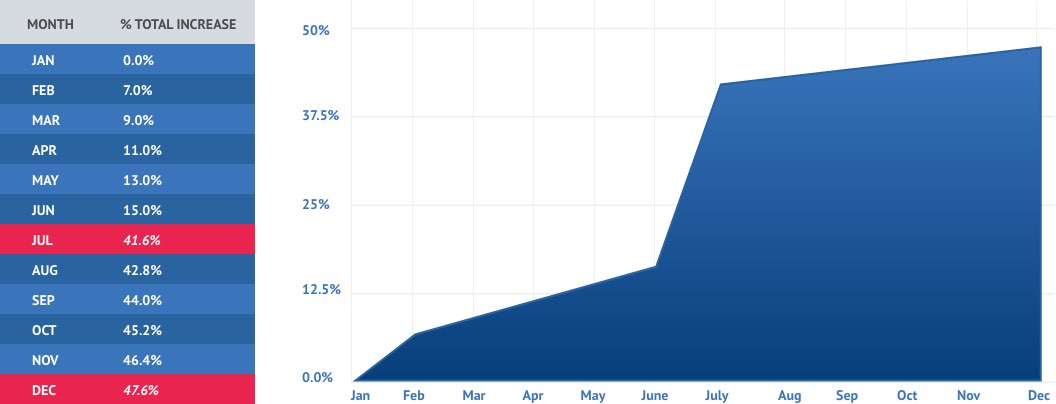

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

If Dallas Property Tax Rates Are Going Down Why Are My Payments Going Up Mansion Global

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Learn About Dallas County Property Taxes

Tax Rates Richardson Economic Development Partnership

Dfw Property Tax Rates In Dallas Fort Worth Texas

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Why Are Texas Property Taxes So High Home Tax Solutions

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

North Texas Homeowners Getting Sticker Shock With New Property Tax Appraisals

Tax Information City Of Sachse Official Website

Dfw Property Tax Rates In Dallas Fort Worth Texas

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease